Applicability of The Companies Act 2013 - November 2014 CA Exams

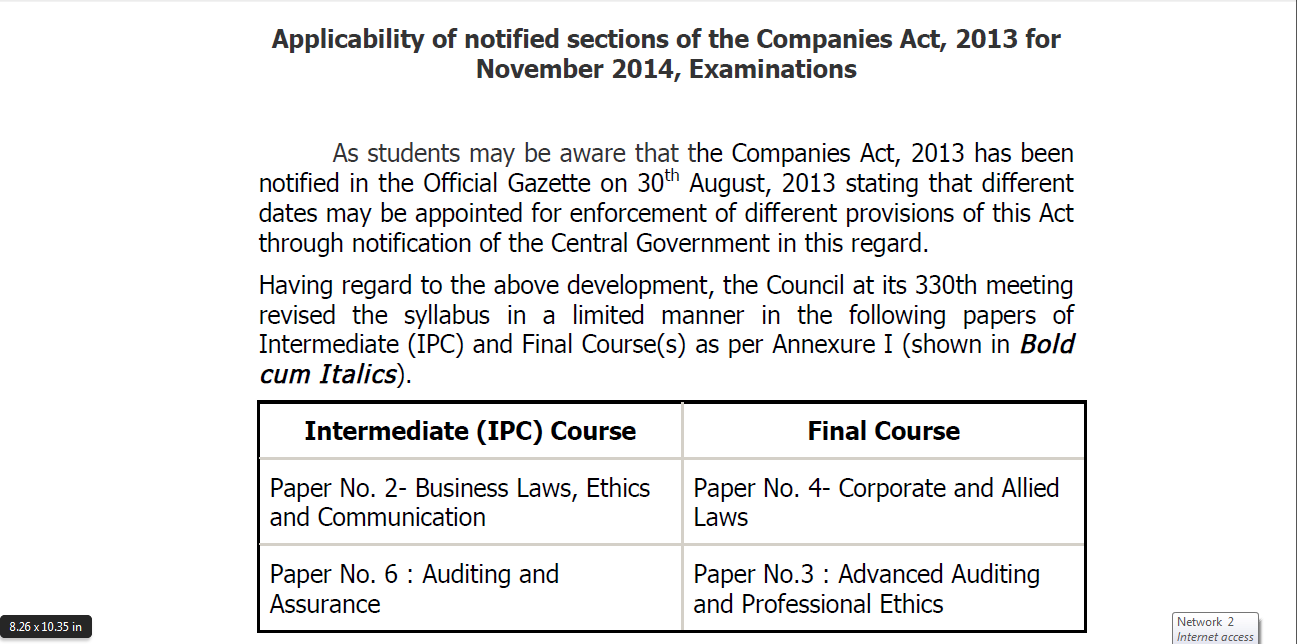

The Central

Government has notified 98 sections of The Companies Act 2013 on 12th

September, 2013. Accordingly, those 98 notified sections are applicable for

November 2014 examinations corresponding to their bifurcation into the

Intermediate (IPC) and Final Course(s), i.e. from these 98 sections, 53 sections have been included in the

Paper – 2, Business Laws, Ethics and Communication, Intermediate (IPC) Course,

and 45 have been included in the Paper- 4, Corporate and Allied Laws, Final

Course.

For reference and

benefit of our students, the Board of Studies has released the following

publications relevant for November, 2014 examinations for Paper – 2, Business

Laws, Ethics and Communication, Intermediate (IPC) Course, and Paper- 4,

Corporate and Allied Laws, Final Course:

Supplementary study material for Intermediate (IPC) Course

Intermediate (IPC) Course

SYLLABUS

__________________________________________________

PAPER – 2 :

BUSINESS LAWS, ETHICS AND COMMUNICATION

PART I – BUSINESS

LAWS (60 MARKS)

Business Laws (30 Marks)

1. The Indian

Contract Act, 18722. The Negotiable Instruments Act, 1881

3. The Payment of Bonus Act, 1965

4. The Employees’ Provident Fund and Miscellaneous Provisions Act, 1952

5. The Payment of Gratuity Act, 1972.

Company Law (30

Marks)

The

Companies Act, 1956 – Sections 1 to 197

(a)

Preliminary

(b)

Board of Company Law Administration ─ National Company Law Tribunal; Appellate

Tribunal

(c)

Incorporation of Company and Matters Incidental thereto

(d)

Prospectus and Allotment, and other matters relating to use of Shares or

Debentures

(e)

Share Capital and Debentures

(f)

Registration of Charges

(g)

Management and Administration – General Provisions – Registered office and

name, Restrictions on commencement of business, Registers of members and

debentures holders, Foreign registers of members or debenture holders, Annual

returns, General provisions regarding registers and returns, Meetings and

proceedings.

(i)

Company Law in a computerized Environment – E-filing.

Note: If any provision of The Companies

Act 2013 comes into force in place of an existing provision under the Companies

Act, 1956 or otherwise by way of new provision, the syllabus would accordingly

include the corresponding or new provisions of The Companies Act 2013, as the

case may be.

Recommended Post

________________________________________________________________

Part II – : ETHICS (20 Marks)

1. Introduction to Business Ethics

The

nature, purpose of ethics and morals for organizational interests; Ethics and

Conflicts of Interests; Ethical and Social Implications of business policies

and decisions; Corporate Social Responsibility; Ethical issues in Corporate

Governance.

2. Environment issues

Protecting

the Natural Environment – Prevention of Pollution and Depletion of Natural

Resources; Conservation of Natural Resources.

3. Ethics in Workplace

Individual

in the organisation, discrimination, harassment, gender equality.

4. Ethics in Marketing and Consumer Protection

Healthy

competition and protecting consumer’s interest.

5. Ethics in Accounting and Finance

Importance,

issues and common problems.

Part III – COMMUNICATION (20 Marks)

1. Elements of Communication

(a)

Forms of Communication: Formal and Informal, Interdepartmental, Verbal and

nonverbal;

Active

listening and critical thinking

(b)

Presentation skills including conducting meeting, press conference

(c)

Planning and Composing Business messages

(d)

Communication channels

(e)

Communicating Corporate culture, change, innovative spirits

(f)

Communication breakdowns

(g)

Communication ethics

(h)

Groups dynamics; handling group conflicts, consensus building; influencing and

persuasion skills; Negotiating and bargaining

(i) Emotional

intelligence – Emotional Quotient

(j)

Soft skills – personality traits; Interpersonal skills ; leadership

2. Communication in Business Environment

(a)

Business Meetings – Notice, Agenda, Minutes, Chairperson’s speech

(b)

Press releases

(c)

Corporate announcements by stock exchanges

(d)

Reporting of proceedings of a meeting

3. Basic understanding of legal deeds and documents

(a)

Partnership deed

(b)

Power of Attorney

(c)

Lease deed

(d)

Affidavit

(e)

Indemnity bond

(f)

Gift deed

(g)

Memorandum and articles of association of a company

(h)

Annual Report of a company

SYLLABUS

PAPER – 6 :

AUDITING AND ASSURANCE

________________________________________

1. Auditing Concepts ─ Nature and

limitations of Auditing, Basic Principles governing an audit, Ethical

principles and concept of Auditor’s Independence, Relationship of auditing with

other disciplines.

2. Standards on Auditing and Guidance

Notes ─ Overview, Standard-setting process, Role of

International Auditing and Assurance Standards Board, Standards on Auditing

issued by the ICAI; Guidance Note(s) on ─ Audit of Fixed Assets, Audit of

Inventories, Audit of Investments, Audit of Debtors, Loans and Advances, Audit

of Cash and Bank Balances, Audit of Miscellaneous Expenditure, Audit of

Liabilities, Audit of Revenue, Audit of Expenses and provision for proposed

dividends.

3. Auditing engagement ─ Audit planning,

Audit programme, Control of quality of audit work ─ Delegation and supervision

of audit work.

4. Documentation ─ Audit working

papers, Audit files: Permanent and current audit files, Ownership and custody

of working papers.

5. Audit evidence ─ Audit procedures

for obtaining evidence, Sources of evidence, Reliability of audit evidence,

Methods of obtaining audit evidence ─ Physical verification, Documentation,

Direct confirmation, Re-computation, Analytical review techniques,

Representation by management, Obtaining certificate.

6. Internal Control ─ Elements of

internal control, Review and documentation, Evaluation of internal control

system, Internal control questionnaire, Internal control check list, Tests of

control, Application of concept of materiality and audit risk, Concept of

internal audit.

7. Internal Control

and Computerized Environment, Approaches to Auditing in Computerised

Environment.

8. Auditing Sampling ─ Types of

sampling, Test checking, Techniques of test checks.

9. Analytical review procedures.

10. Audit of payments ─ General

considerations, Wages, Capital expenditure, Other payments and expenses, Petty

cash payments, Bank payments, Bank reconciliation.

11. Audit of receipts ─ General

considerations, Cash sales, Receipts from debtors, Other Receipts.

12. Audit of Purchases ─ Vouching cash

and credit purchases, Forward purchases, Purchase returns, Allowance received

from suppliers.

13. Audit of Sales ─ Vouching of cash

and credit sales, Goods on consignment, Sale on approval basis, Sale under

hire-purchase agreement, Returnable containers, Various types of allowances

given to customers, Sale returns.

14. Audit of suppliers’ ledger and the

debtors’ ledger ─ Self-balancing and the sectional balancing

system, Total or control accounts, Confirmatory statements from credit

customers and suppliers, Provision for bad and doubtful debts, Writing off of

bad debts.

15. Audit of

impersonal ledger ─ Capital expenditure, deferred revenue expenditure and

revenue expenditure, Outstanding expenses and income, Repairs and renewals,

Distinction between reserves and provisions, Implications of change in the

basis of accounting.

16. Audit of assets and liabilities.

17. Company Audit ─ Audit of

Shares, Qualifications and Disqualifications of Auditors, Appointment of

auditors, Removal of auditors, Powers and duties of auditors, Branch audit ,

Joint audit , Special audit, Reporting requirements under the Companies Act,

1956.

18. Audit Report ─ Qualifications,

Disclaimers, Adverse opinion, Disclosures, Reports and certificates.

19. Special points in

audit of different types of undertakings, i.e., Educational institutions,

Hotels, Clubs, Hospitals, Hire-purchase and leasing companies (excluding banks,

electricity companies, cooperative societies, and insurance companies).

20. Features and basic

principles of government audit, Local bodies and not-forprofit organizations,

Comptroller and Auditor General and its constitutional role.

Note: If any provision of The Companies

Act 2013 comes into force in place of an existing provision under the Companies

Act, 1956 or otherwise by way of new provision, the syllabus would accordingly

include the corresponding or new provisions of The Companies Act 2013, as the

case may be.

Download | Notification

Applicability of The Companies Act 2013 - November 2014 CA Exams

Reviewed by Unknown

on

6:17:00 PM

Rating:

Reviewed by Unknown

on

6:17:00 PM

Rating:

Reviewed by Unknown

on

6:17:00 PM

Rating:

Reviewed by Unknown

on

6:17:00 PM

Rating:

It is very informative and unique. You have explained it very well. I would like to read more articles like this. You have done a good work. Thanks for sharing..

ReplyDeleteAuditing Services Bangalore